Acquisition project | CheQ

There was a world a few years back, where people had to keep track of the due dates of all their credit cards somewhere. Hard to imagine right? How organised would someone have to be for the same?😵💫 My self-diagnosed ADHD could never...

Yes, you can set up auto payments if you have a savings account in the bank, but what if you don't? 😱

You risk losing your credit score if you do not pay on time!!!!!! Do you know the repercussions of having a bad credit score? Nobody wants to give you big loans. If they do, they charge super high-interest interest rates. Absolutely, not my game 😑

We were told before to don't buy credit cards, they are a trap! I believed the same too before. What if I miss a payment? ⚠️

The scenario is very different today. I have 4 credit cards and I am reminded of the payments on time. I pay all my credit bills on time and boast a great credit score. 😎

How did this happen???🤔

INTRODUCING 🥁🥁🥁

Credit Management apps

Yes, your credit cards can be tracked from apps now to remind you of timely payments and help make the payment from a single place. How better the world is now... Phew😅

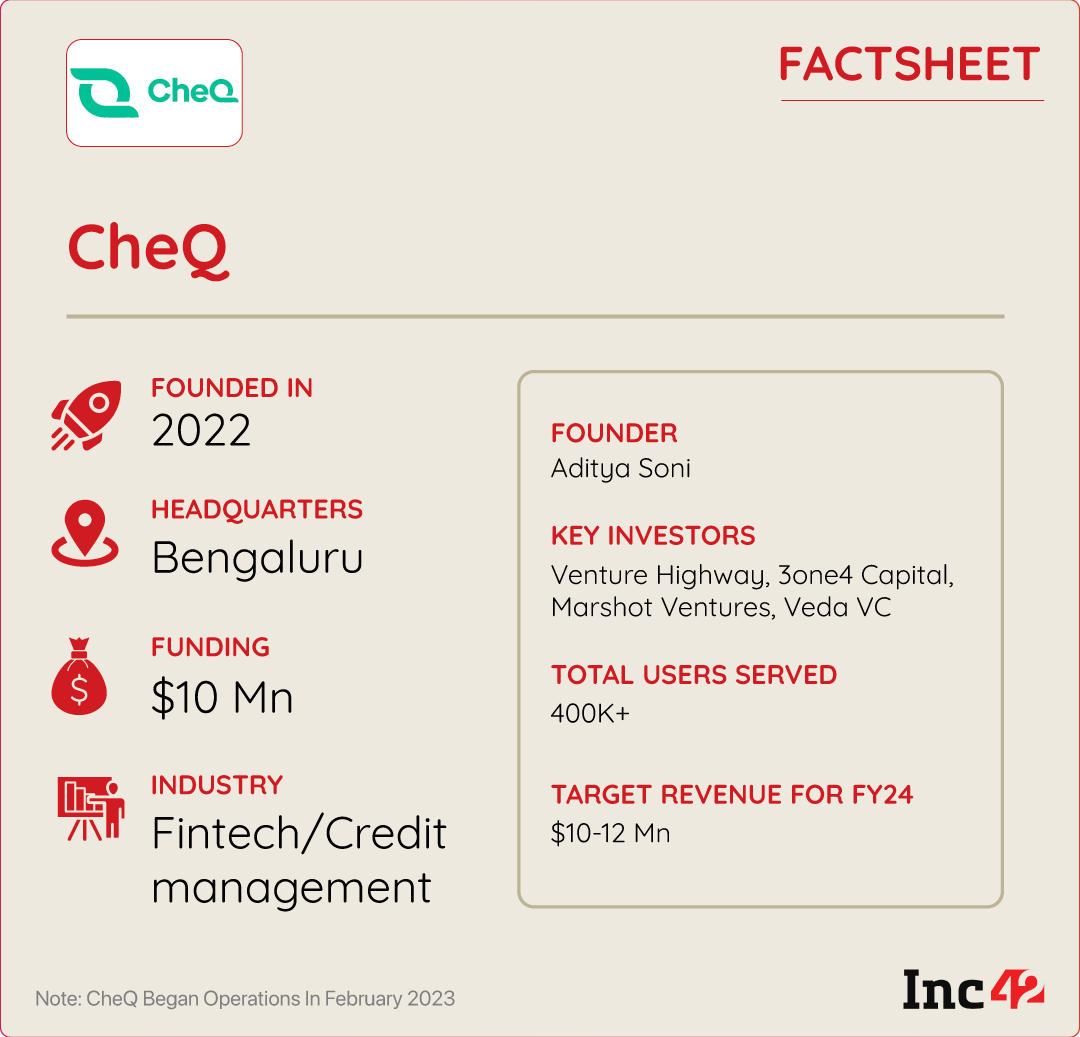

Let's deep dive into one of the emerging products that has turned 1 year old.

The Product

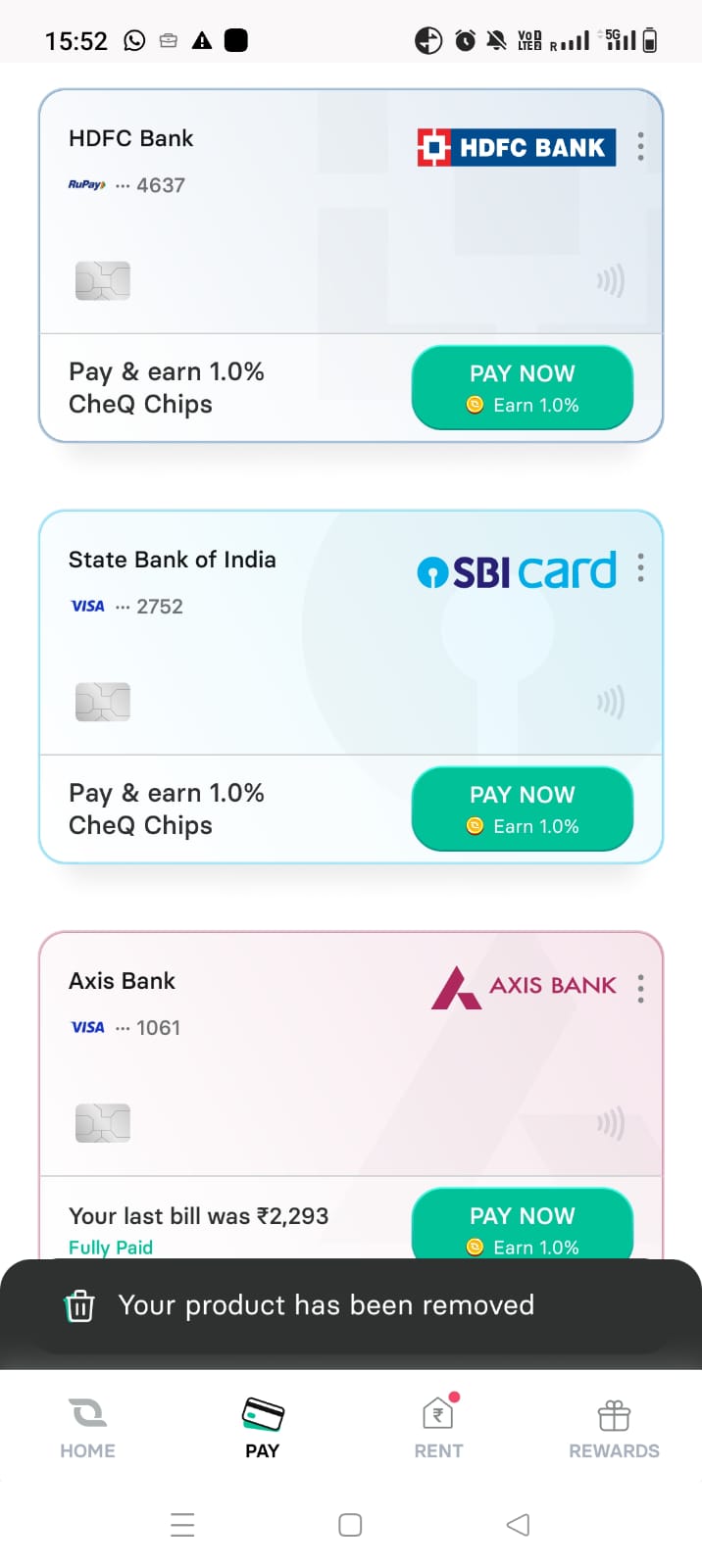

CheQ is a credit management company for card, loan EMI payment and BNPL services. Its core value proposition is to pay all of your credit card, loan EMIs, and BNPL from a single platform while earning 1% of the bill in the form of CheQ coins (platform currency). It is only used for credit management and has a simple UI for this service. It's a niche product for credit management. Its best feature is "Pay Together", which can pay all your credit bills in a single transaction.

Source: Inc42

Features and Functionalities:

- Pay together - This is a flagship feature to pay all the bills generated together

- Pay now - This allows you to pay the credit bill of the product(credit card, loan).

- Rent - Helps pay rental bills, maintenance, school fees, tuition etc

- Rewards - This keeps track of the CheQ coins which is the platform currency. This section also has multiple vouchers available. The sections shows all vouchers availed and if any have expired.

- CheQ coins - This is the main platform currency. It offers direct 1% coins of the payment you make above 100 INR. The coins can be used to avail discount in the next payment or to get vouchers. Some amazing vouchers like voucher for Amazon are also available.

- Vouchers - There are multiple vouchers on the app. Like Amazon, Myntra, MMT, sometimes OLA, PVR, Fasoos, Oven Story etc. Every voucher has a different redemption rate. Some vouchers can give 1 coin = 0.10 INR redemption, and some can give 1 coin = 10 INR.

- Experian score - You can check the experian score from the app itself for the current month and the previous months.

- Refer - This is for referrals. This keeps track of the referrals and coins/vouchers earned from it.

- CheQ Kredit - They have now introduced

What works for the product?

- App only revolves around credit management

- Good reward system and vouchers

- Simple UI

- Ease of payment

- Timely reminders

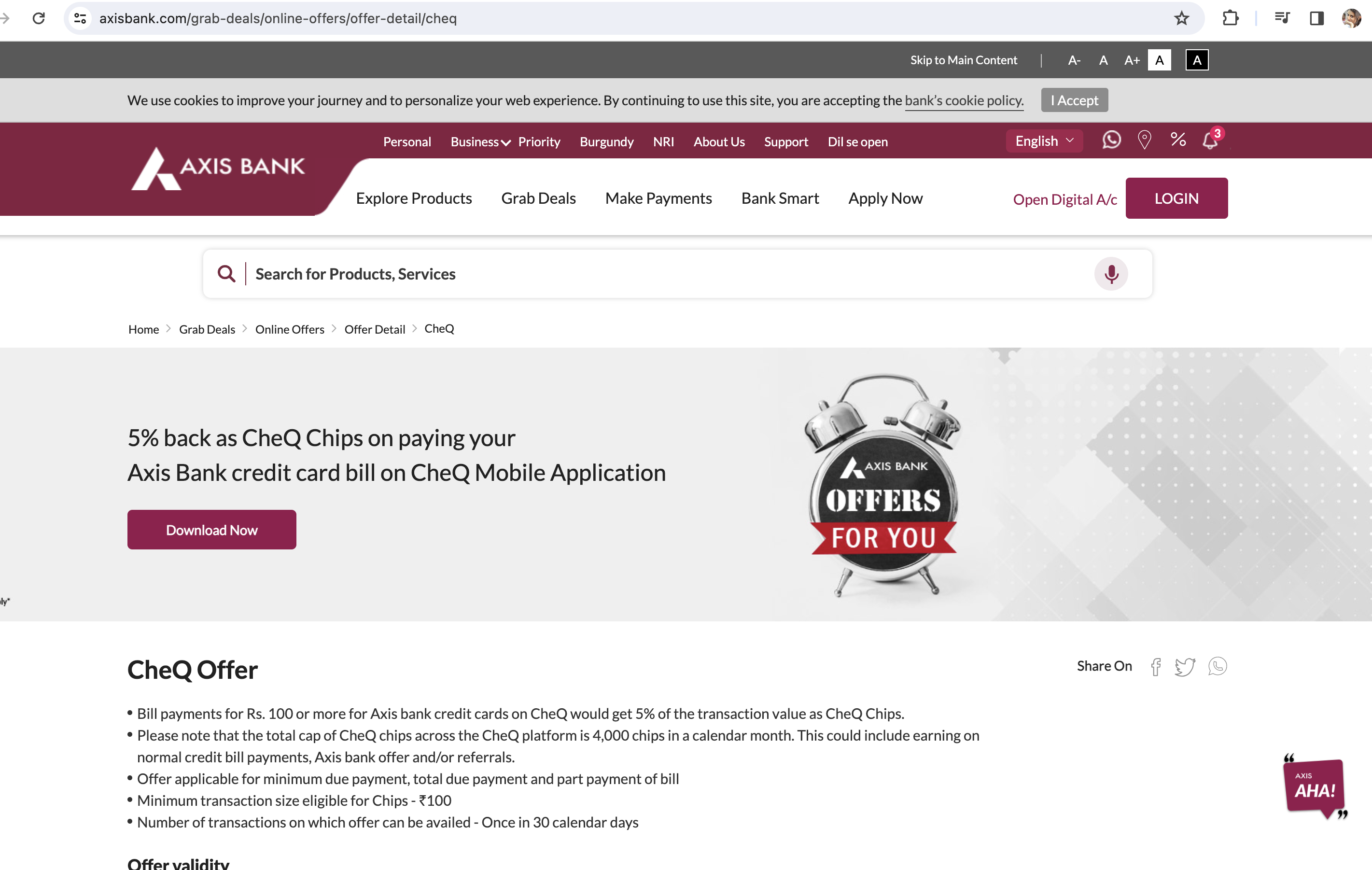

- Partnership with AXIS bank encourages AXIS credit users to pay through the app. You recieve 5% cheq coins for first payment of AXIS credit bill in a month.

Improvement needed:

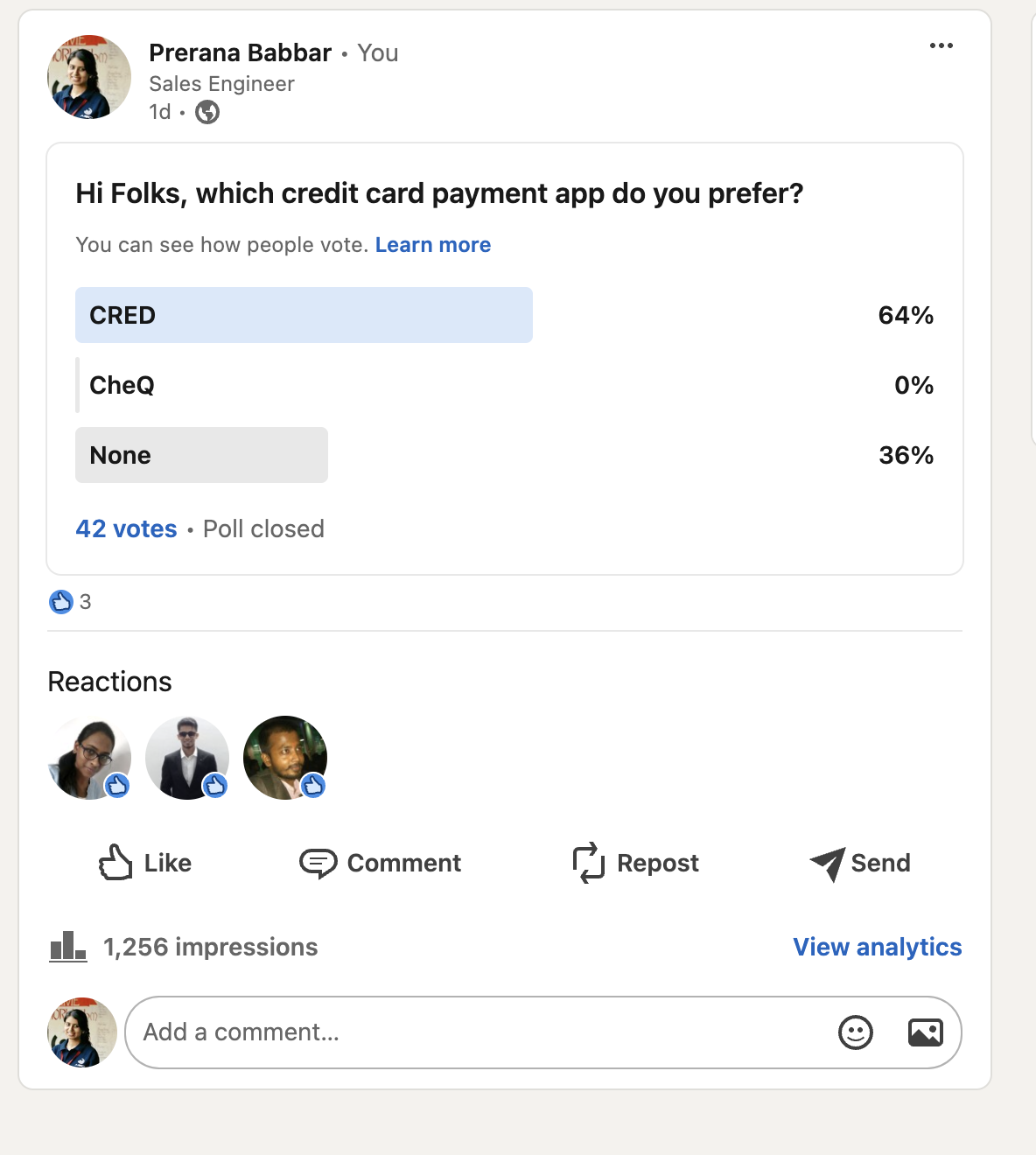

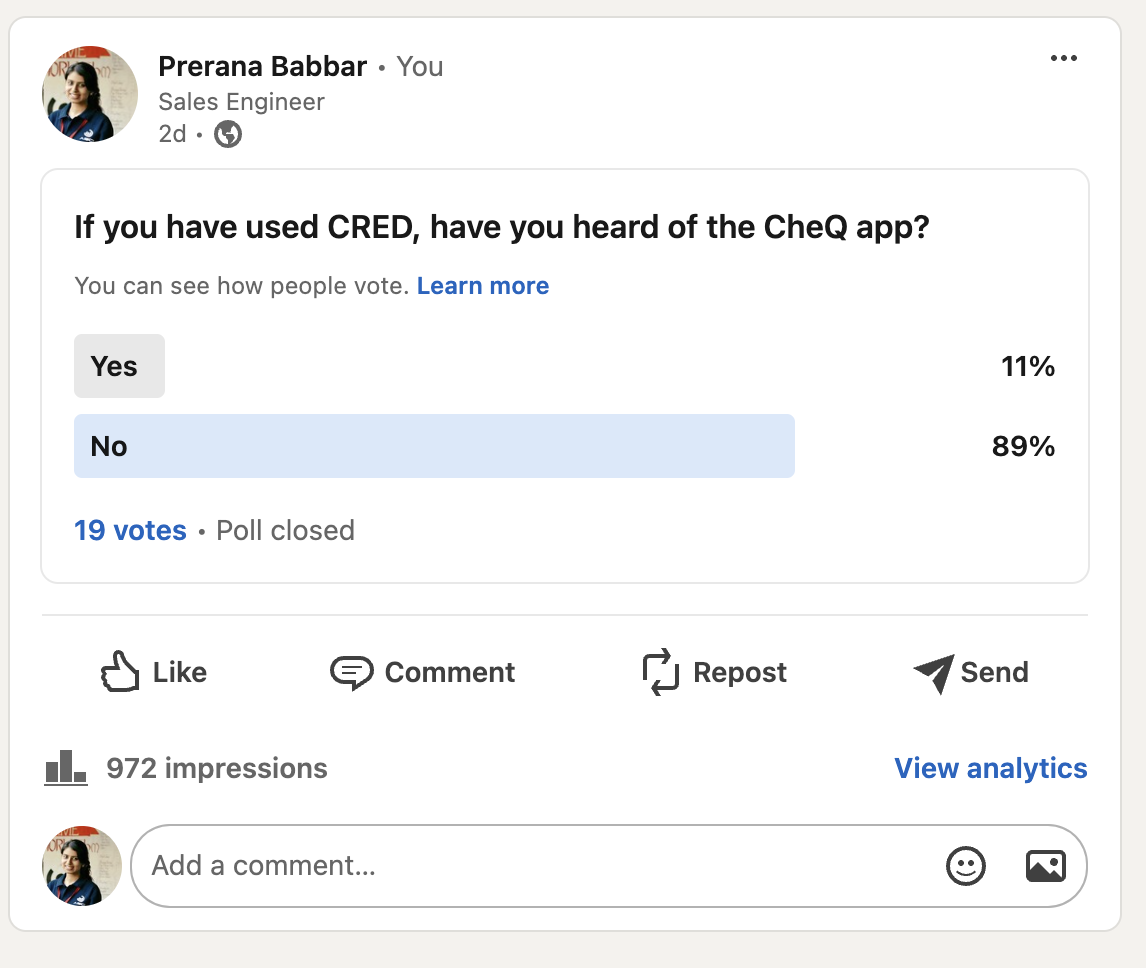

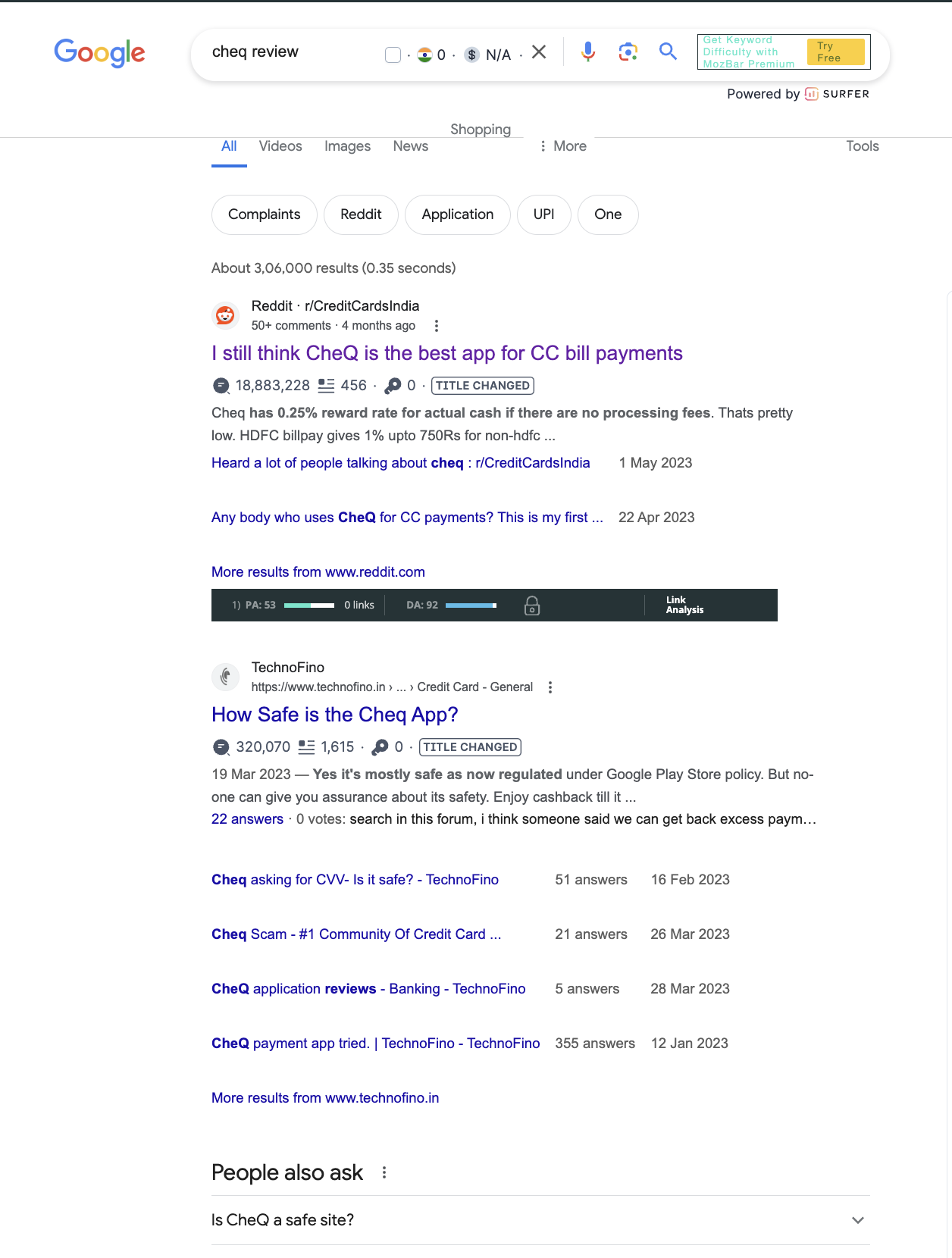

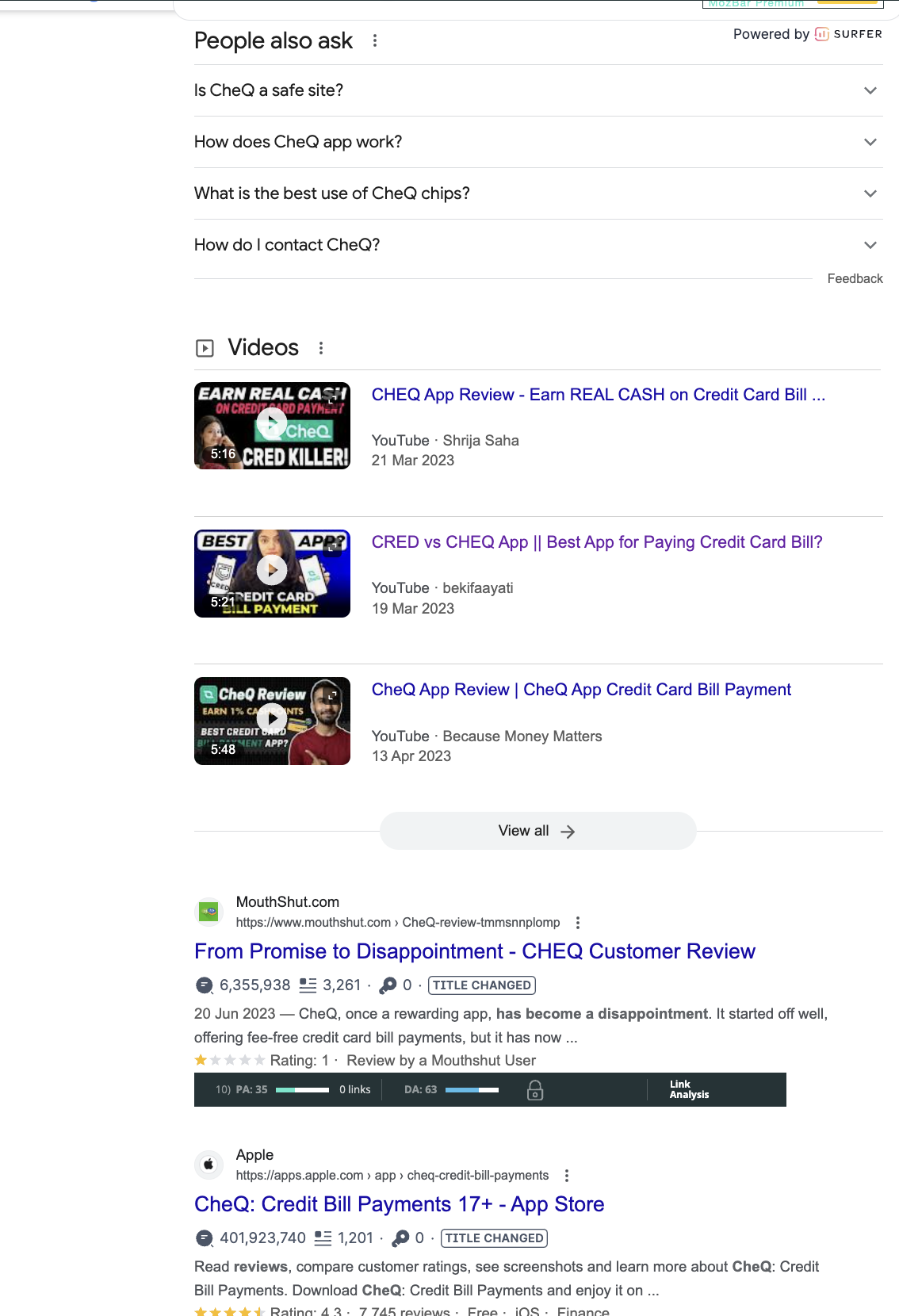

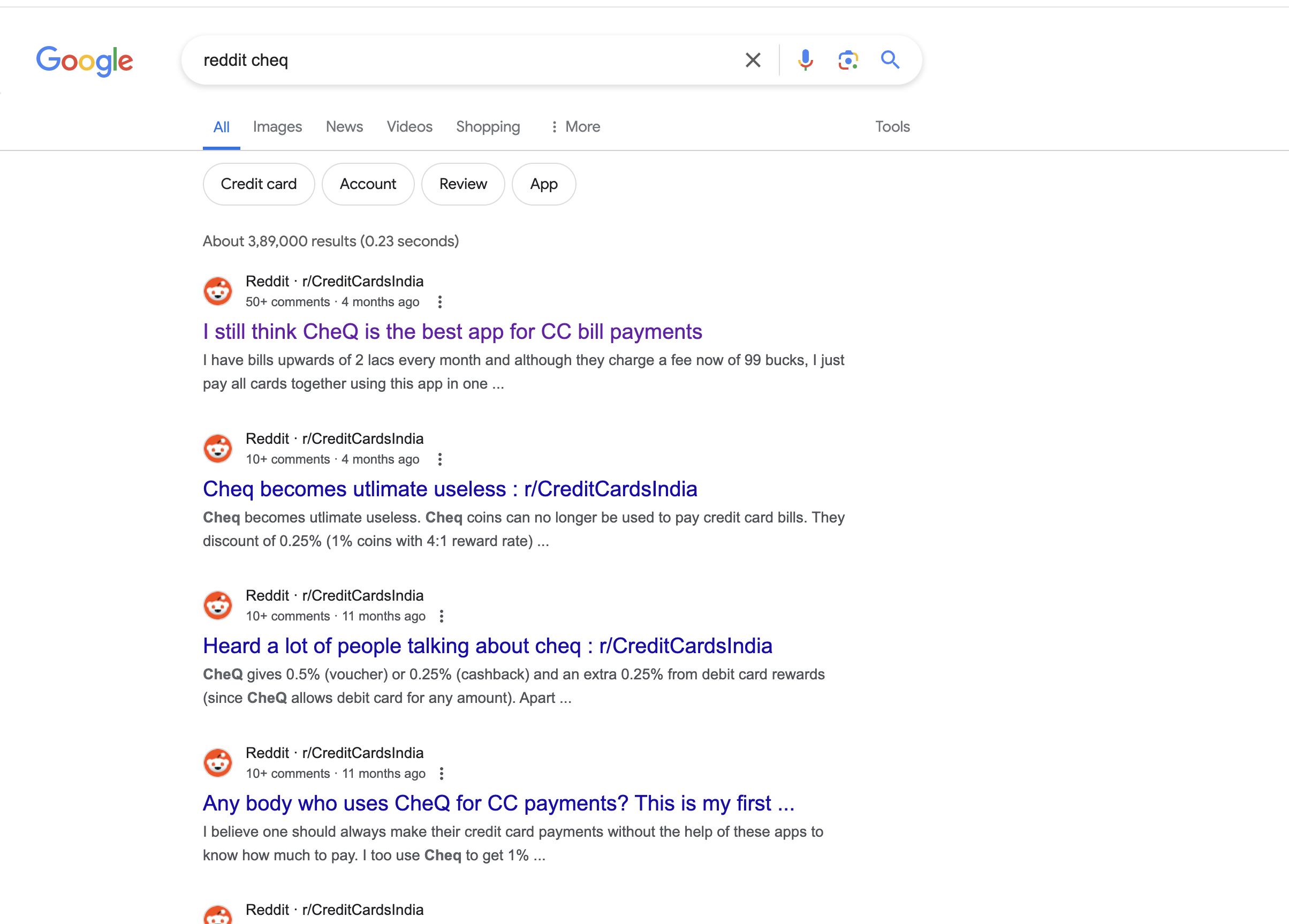

Low discoverability. People haven't heard about the product.

Google searches do not show the product website even on related keywords.

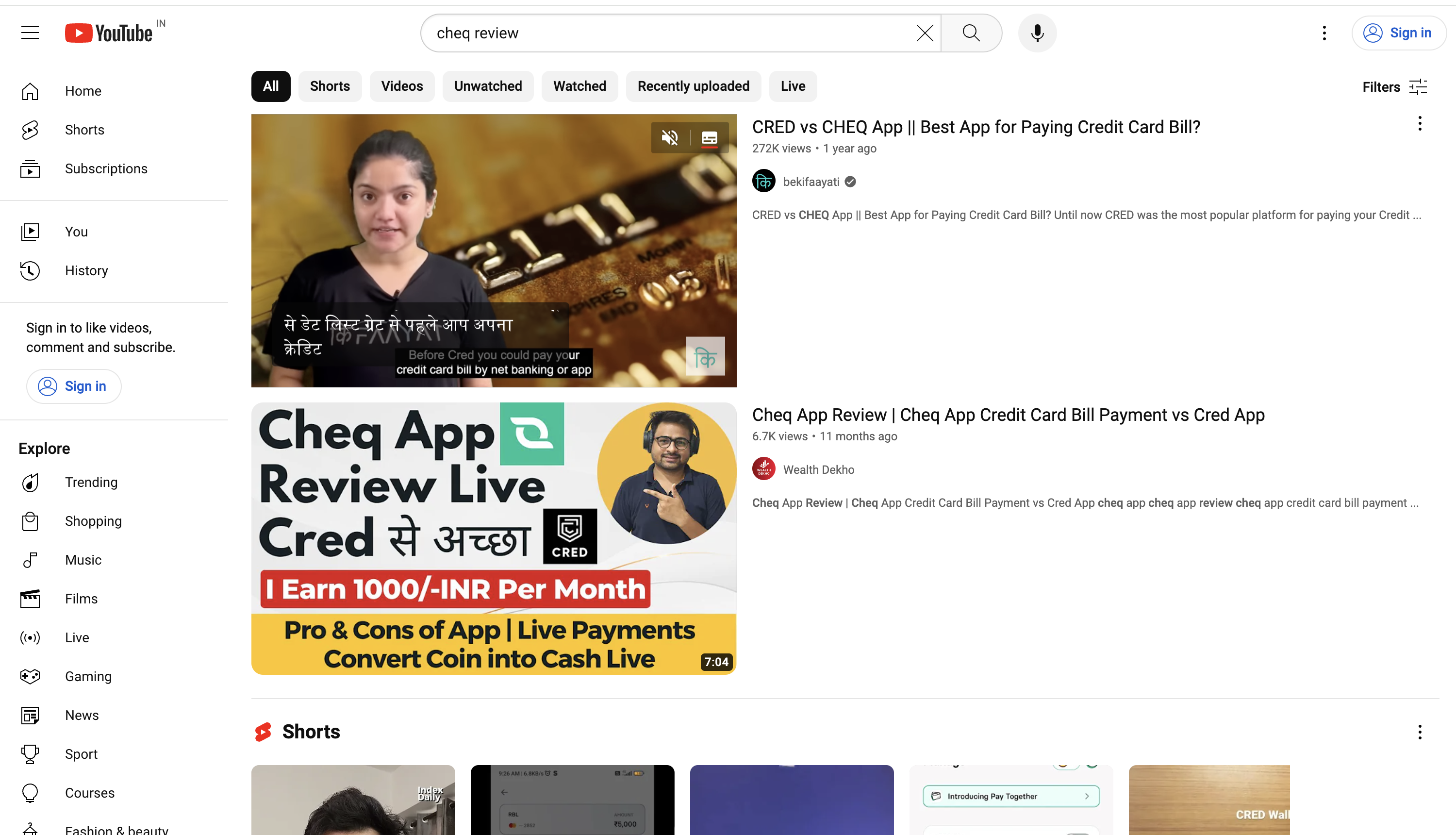

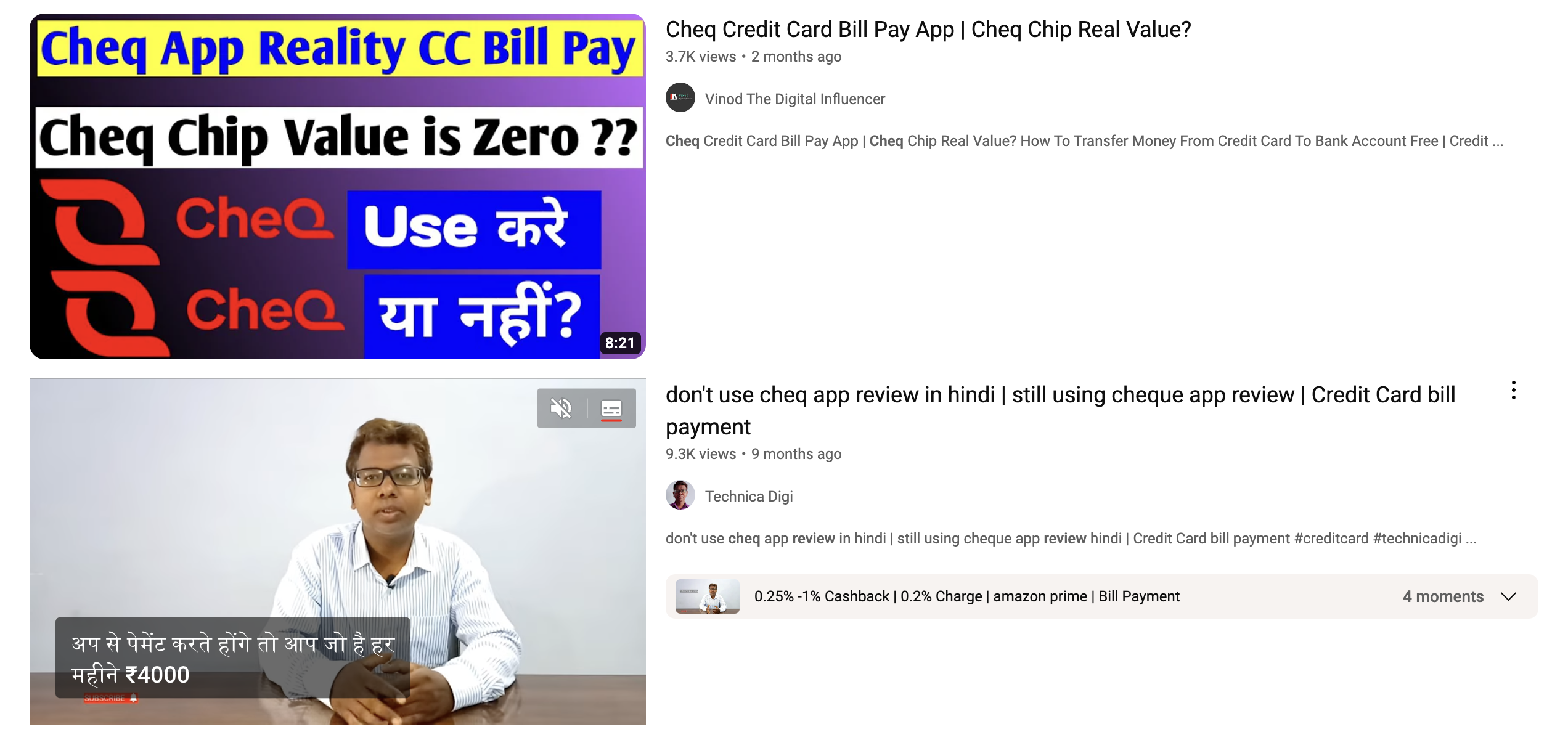

CheQ has no presence on YouTube and Instagram only has about 1.4k followers.

The referral system can be made better.

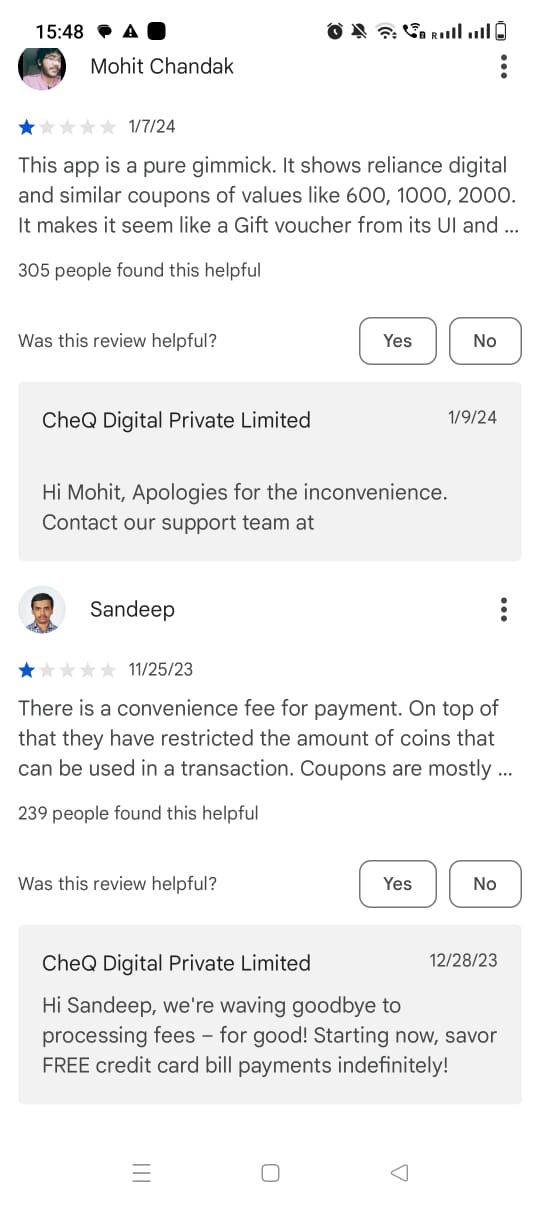

The processing fee introduction in between was a bad move.

Product Flow

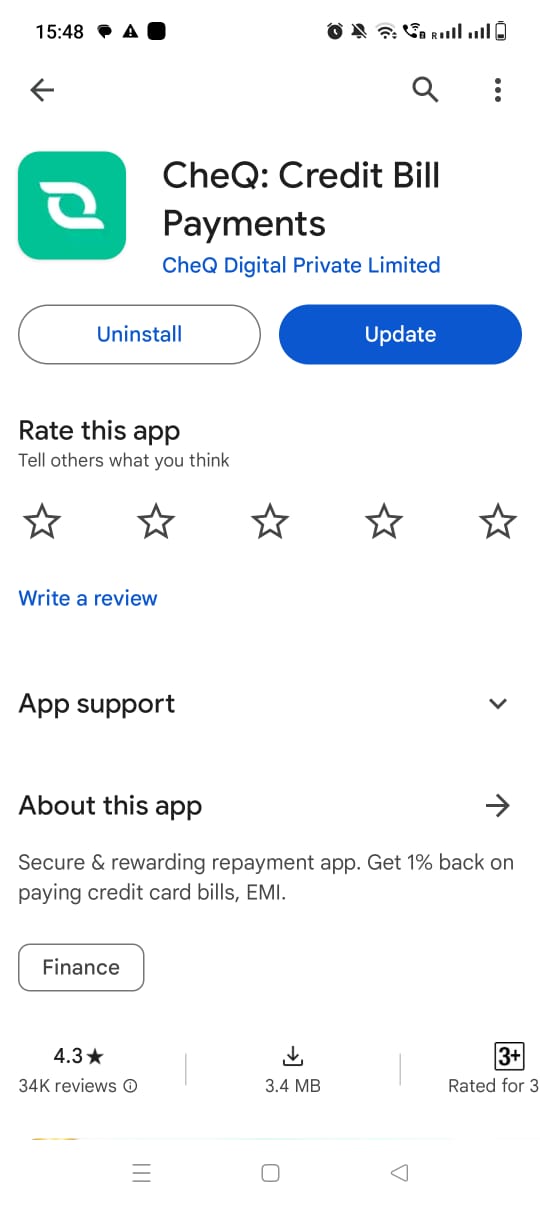

Android mobile application

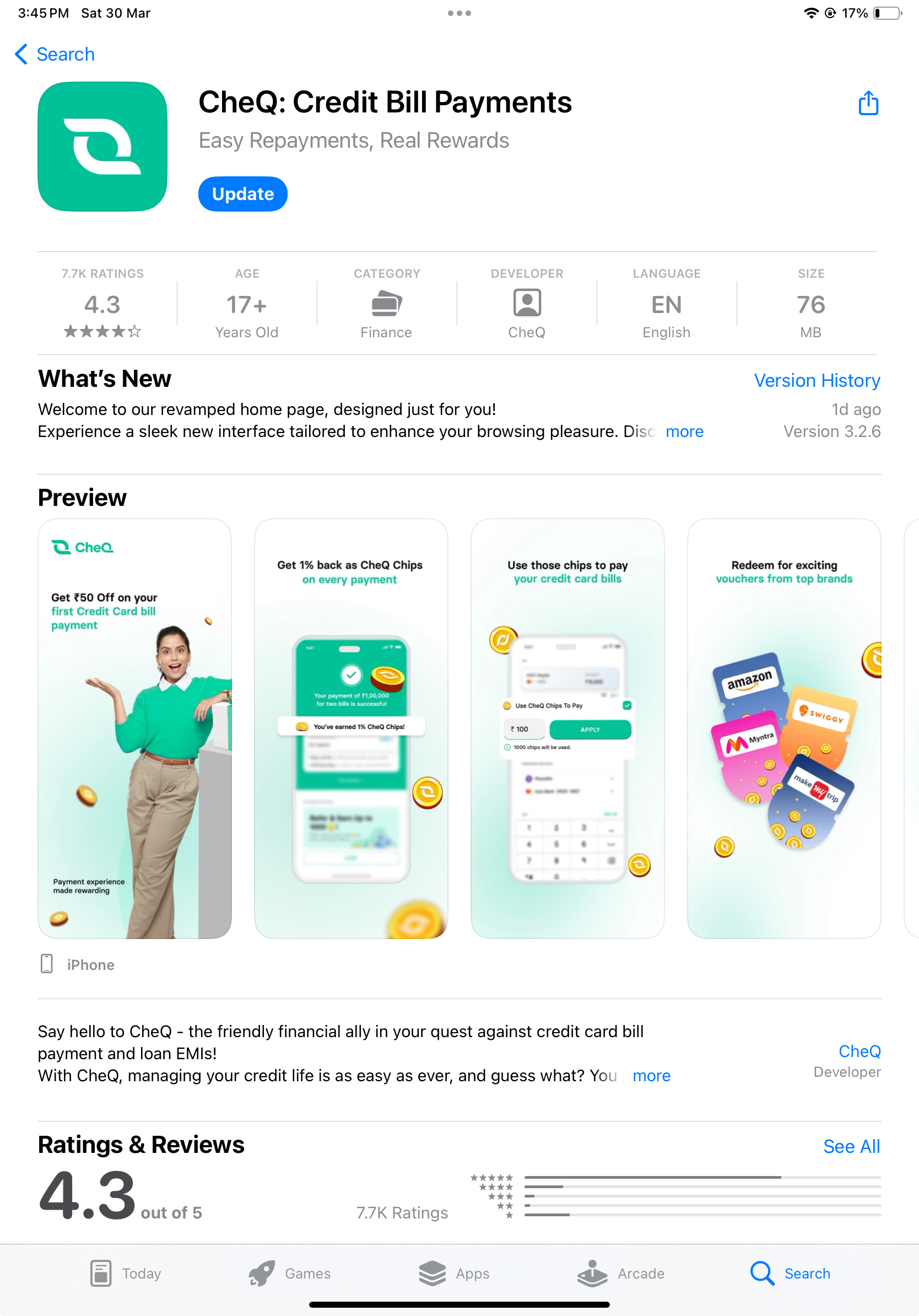

IOS application on my iPad

Website

The website gives a great UI and only gives the option to download the mobile application.

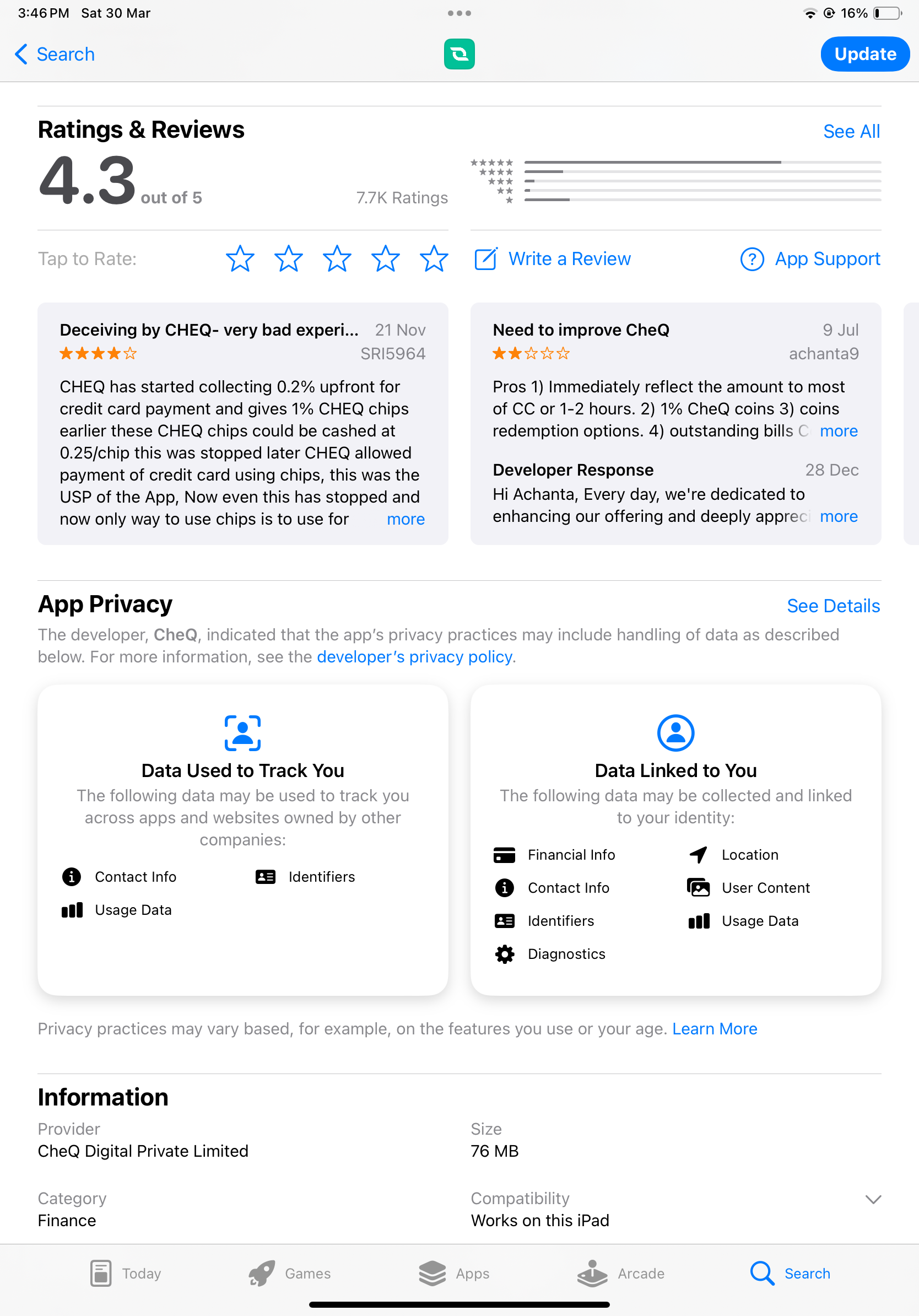

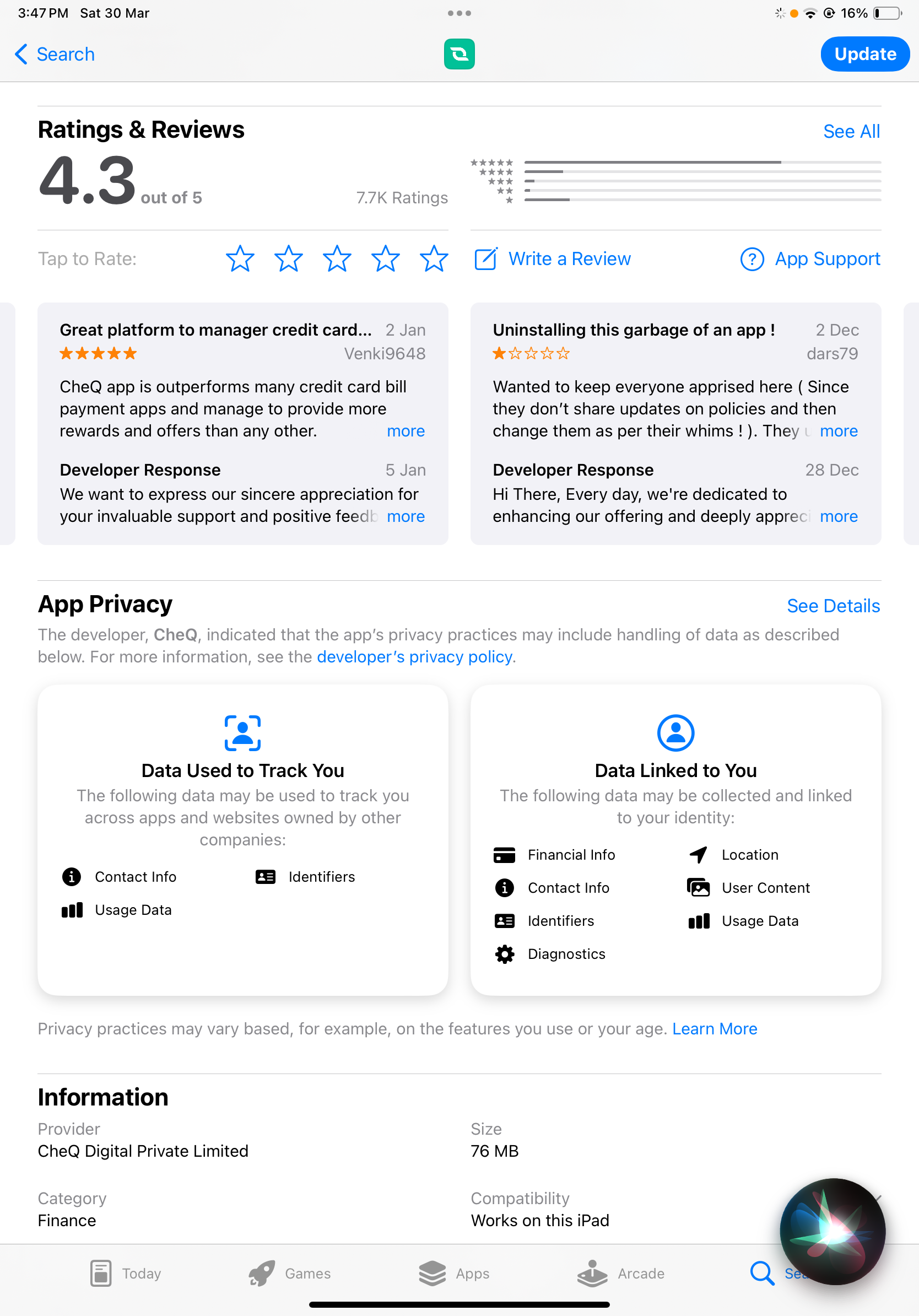

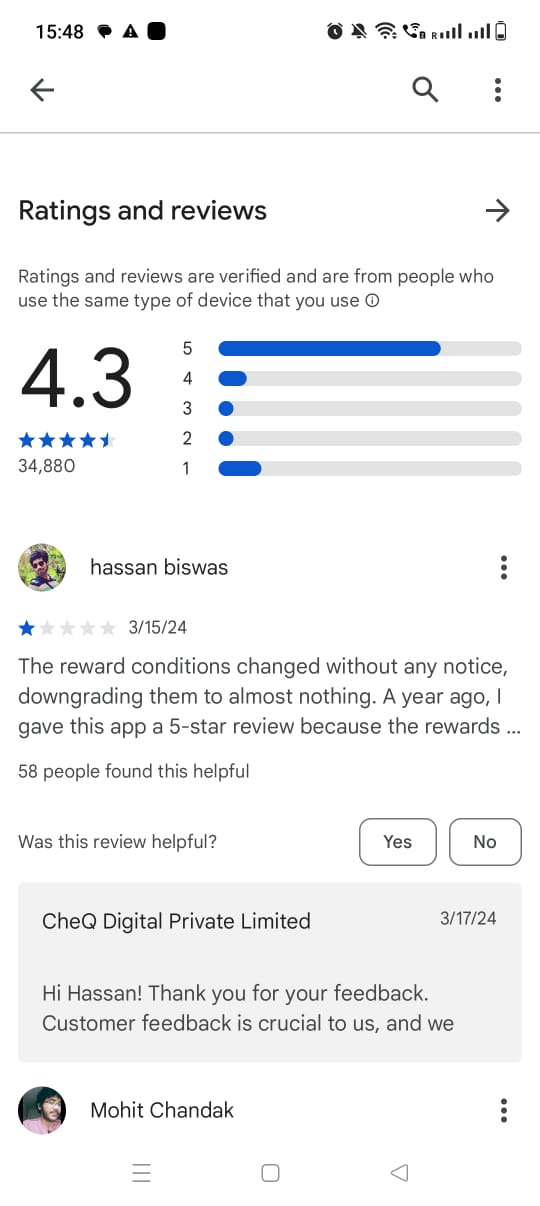

Product Reviews and Search Results

App store

Playstore

Youtube

Findings

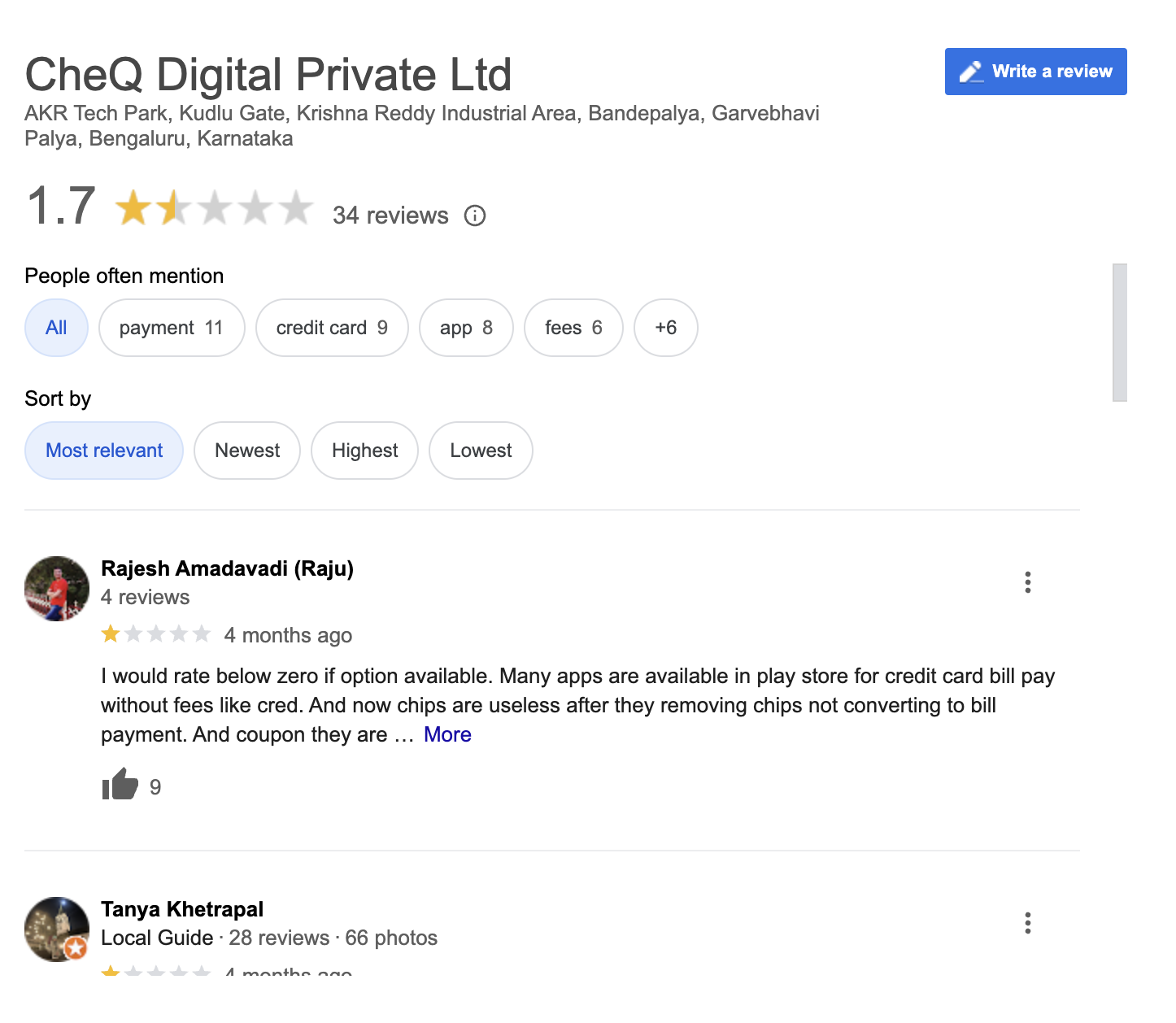

- Some users are happy with the cheq coins. They like the reward structure. Some users are unhappy since the rewards have been devalued.

- The product received backlash for introducing a processing fee in between while its competitors did not charge for it. Many users stopped using the product after that. Now the product doesn't have a processing fee.

- The users like the simple and intuitive UI of the application which only has credit management services.

- Users are complaining that the HDFC bank debit card feature has been removed.

Websites with dedicated articles:

https://yourstory.com/2022/06/funding-fintech-startup-cheq-10m-seed-round

The User

ICP

| ICP1 (early professional) | ICP2 (mid professional) | ICP3(self employed) | ICP4(senior professional) |

ICP Name | Amber | Rachel | Bhaman | Anant |

Age | 18-28 | 25-40 | 25-40 | 40-55 |

Gender | Any | Any | Male | Male |

Location | Any Tier | TIer1/Tier2 | Any | Tier1/Tier2 |

Marital Status | Single | Any | Any | Married |

Companies | Startup, MNC | MNC, startup | own business | MNC |

Income levels | 1L-10L | 10-40 lpa | 10-50lpa | >20 lpa |

Monthly spends | 10-30k | 30k-1L | 30-2L | 50k-2L |

Do you believe in maximising CC benefits | Yes | Yes | Yes | Yes |

Number of credit cards | 2 | 4 | 3 | 4 |

Credit Score range | >500 | >650 | >600 | >700 |

Primary reason for getting a card | For getting lounge access and cashbacks | Credit, build credit history, rewards points and cashbacks | Cashback | Credit, exclusive benefits like golf |

Where do they spend money on? | Online shopping, gaming, movies, cafes | Shopping, rent, grcoeries, school fees, maintenance fees, rent,EMI, transport, house-help, vactions | Business transcations, household expenses, travel, fashion | Shopping, college fees of childred, maintenance fees, loan EMI, home related activities |

Pain points | Building credit history | Missing credit card or loan payment | Managing multiple credit cards | Multiple bill payments from different platforms |

Financial goals | Make family debt free and achieve about 40 LPA net worth to run family smoothly | Achieve financial freedom. Increase investment portfolio. Real Estate. | Streaming apps like Netflix & YouTube for entertainment, social media surfing on apps like Instagram, Investing and trading apps like Zerodha Kite, Money Control, TradingView | Achieve financial freedom and retire |

How did they discover CheQ? | referral | Axis bank email/referral/reddit | Referral | Referral by family friends |

Online interest | Linkedin, OTT - Prime, Jiocinema, | Linkedin, reddit, instagram, OTT - Netflix, Prime, Youtube, Audible | Watching podcasts, investment apps like zerodha, kite, moneycontrol, tradingview | Podcasts, Finance e and investement , songs - yotutube, OTT |

Offline interest | Sports, Cafes, Movies, pubs | Reading, Sports, Fine Dining | Fitness: Gym and Yoga Fashion: Clothing Going for movies and outdoor activities | Fitness, yoga, walking, vaction, fine dining, golf |

Why they use app | To see all bills and payment dates in a single app. To get free credit score | Pay multiple bills together, check credit score, pay rent/maintenance, pay loan emi | Ease of use and to keep track of credit bills. | Track all credit bills, pay different rent/maintenance fees/college fees |

Why did you first install it? What outcome did yu expect? | Installed by a referral. Expected good cashback on paying bills | On the suggestion of a friend. Expected an app like CRED. | I installed it on a friend's recommendation . Outcome of Convenience, Timely Payments, Tracking | Referral. Expected to pay bill and get a b good discount while paying bill. |

How they chose CC | Compared LTF credit card | Comparing between different rewards structures and cashbacks | Different for personal and different for business | Great reward points like Infinia, good cashback on groceries and petrol |

No of CC’s/loans | 2 | 4 | 2 | 3 |

Do you fear not paying credit bills | No. I check app multiple times a month. | Yes. I have multiple cards. | Yes | No |

ICP Prioritisation:

Attribute/ICP | ICP1 (early professional) | ICP2 (mid professional) | ICP3(self employed) | ICP3(senior professional) |

Ease of adoption | Super easy. They don’t have credit history, hence will install app. Willingenss: Could be willing if projected right. | Easy. They want to maintain and organzie their life. | Medium. They might not want to share their data with 3rd party. | Medium. They already have set ways of paying bills. Need to be shown why app can be great |

Frequency if use | 2-3 days | 4-5 days | 2-3 days | 4-5 days |

Willingeness to pay(by time) | Apetitie: high willingess : high | Apetite: medium, willingness: high | Apetite: medium, winlingness: medium | Apetite: low, Wiligness : medium |

TAM size | Low | Very high | Medium. | High |

Distributin potential | Medium | High | High | Medium |

By above table, I go Mid professional ICP and the self employed ICP.

Product Category

Value Proposition:

Credit Management in a single place including credit cards, BNPL and loans.

Product Stage:

Product is at an early scaling stage. CheQ has turned 1 year old. They were able to raise multiple fundings and have a user base of million users in India.

https://inc42.com/buzz/fintech-startup-cheq-raises-10-mn-launch-credit-management-platform/

https://inc42.com/features/1-mn-users-5-mn-transactions-1-5-mn-revenue-how-cheq-is-transforming-credit-management/ >> 1 Mn+ Users, 5 Mn Transactions, $1.5 Mn Revenue: How CheQ Is Transforming Credit Management

Influencer:

CheQ coins. Flat 1% CheQ coins on all transactions. Even 5% for Axis Bank credit cards. These coins can either be redeemed as cash which can be encashed in banks or used for different bill payments or they can be used to buy vouchers from companies that are super relevant for Indian customers like Amazon, Flipkart, and Myntra. Sometimes, you also get OLA and PVR coupons. Coins value can differ according to the company for which you are buying coupons.

Blocker:

1) Privacy

Data privacy

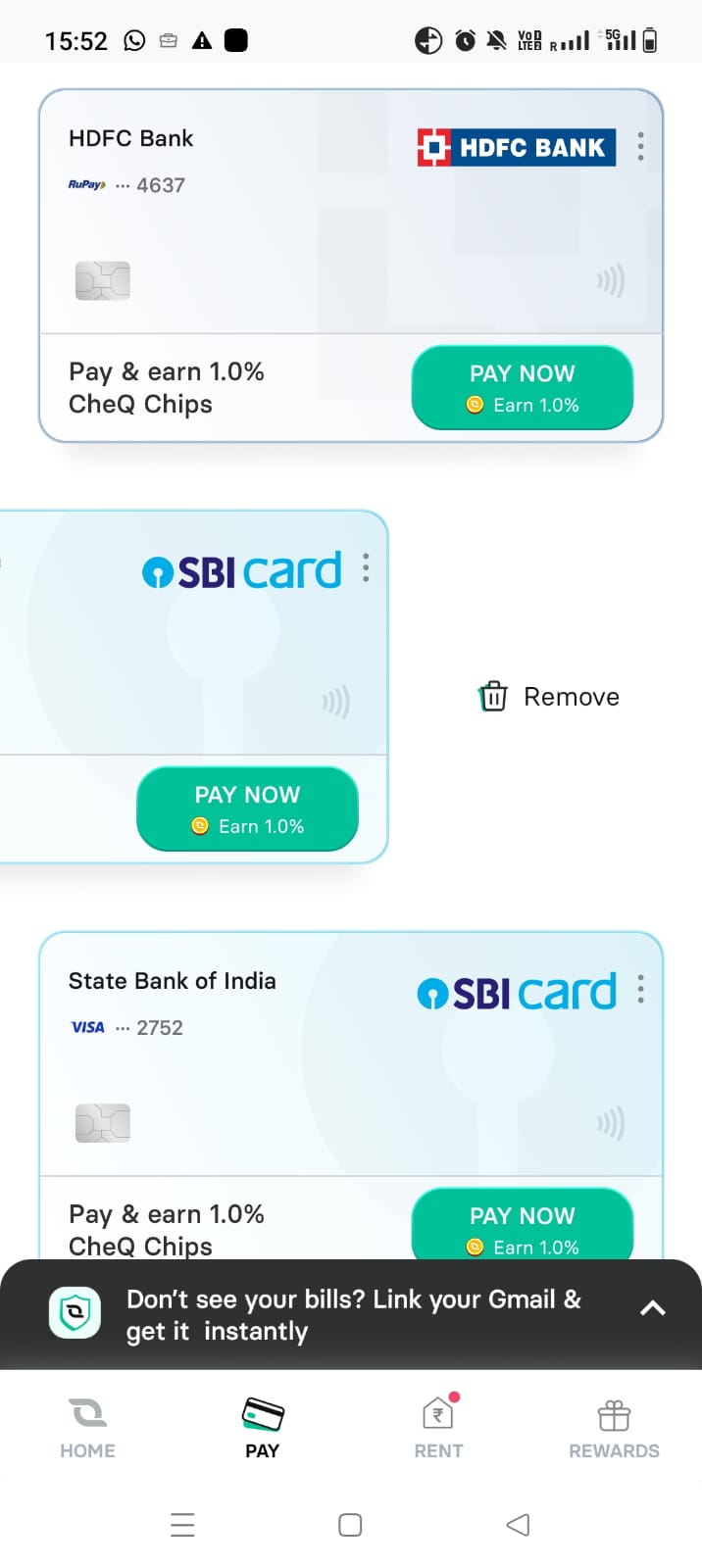

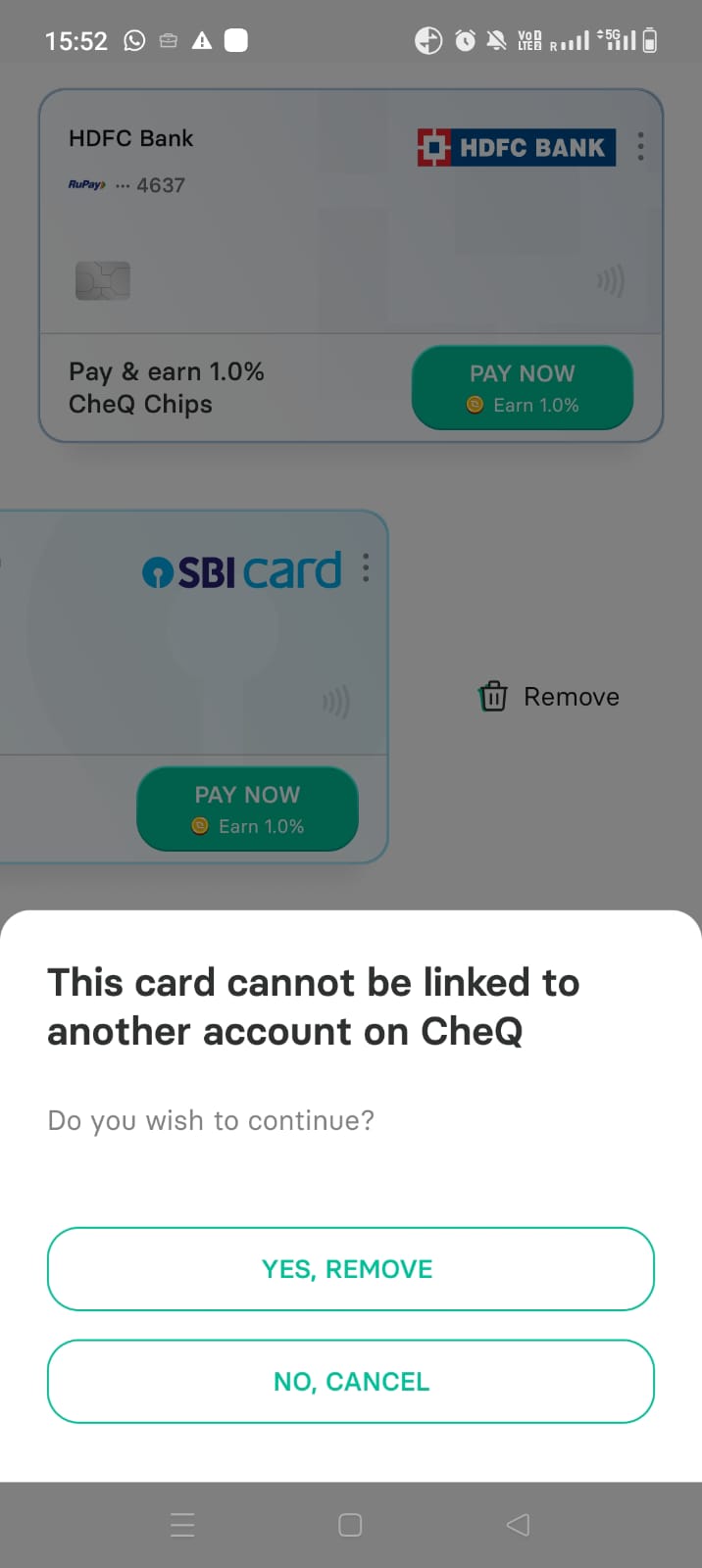

There was an issue of not being able to remove credit cards from the application once you had added them. Many users found it scary.

However, now the credit card can be removed. I have added the screenshots below which show that credit cards can be removed now without any hassle

2) Reliability -

There were some issues with users complaining that it took a few hours to complete the payment. However now, the issue has been resolved and it takes around half an hour. The latest update is that ittook around only 2 minutes.

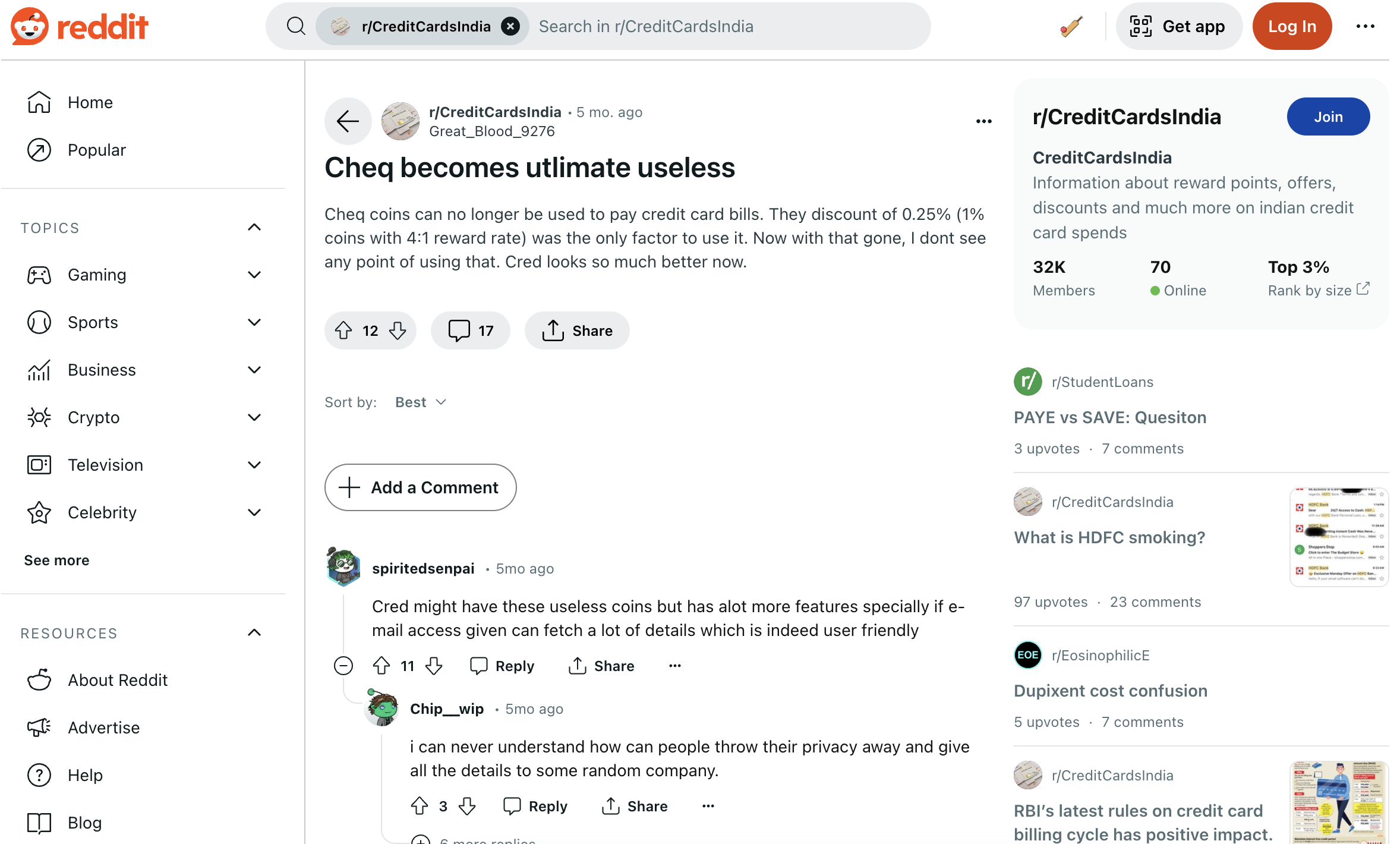

3) Processing Fee -

CheQ wanted to monetise using a processing fee, in between which was 0.2 % capped at 99 rs. Many users found it annoying since the competitor apps like CRED don't charge it. Some found the app still useful since they could still get cashback which was much higher than the processing fee and what competitors would offer. Check this: https://www.reddit.com/r/CreditCardsIndia/comments/17nwbf3/unpopular_opinion_i_still_think_cheq_is_the_best/?rdt=43923 -> Reddit article explaining how CheQ is still useful despite processing fee for some while it's not for others.

Note: Now they have removed the processing fee.

Competitors

https://www.youtube.com/watch?v=d3xgmAzIKfc >> Cred Vs postpe Vs Cheq | Best app for credit card bill payment

https://www.reddit.com/r/CreditCardsIndia/comments/17jmu5y/most_rewarding_way_for_cc_bill_payment/ >> Most rewarding way for CC bill payment

https://www.youtube.com/watch?v=JxqpMvPb26w >> Best Credit Card Bill Payment App 2024 | Get Cashback On Every Credit Card Bill Payment | Live Proof

1) CRED:

CRED is the biggest competitor and the first mover in the credit management space. It is used to manage all utility and credit card bills and keep track of all credit cards in a single place. Needs 750+ CRIF score to join CRED. It provides notifications to users for bill payments.

2) Postpe

Gives 0.25% cashback which can be used to pay other utility bills. This shows the due dates of different cards and minimum and total due.

3) HDFC bill pay

HDFC net banking bill pay section

1% real cashback on other bank's CC bills for Platinum debit cards upto 750rs per month and for HDFC millenia debit card upto 400 rs per month. It does not keep track of any credit card bills. Only used for good cashback.

================================================

Market Size

According to RBI, Credit card usage has jumped 20% in April 2023 compared to 2022, while debit card usage dropped by 31% in the same period. Now the total number of credit cards in India is >10 Cr

https://cardinsider.com/blog/10-crore-milestone-indias-booming-credit-card-market/

Source: Card Insider

TAM:

TAM is all users having credit cards/loans/using BNPL services. According to Forbes in 2023, "India’s credit card penetration is currently estimated at about 5.5% of the population of 1.4 billion, or 77 million people." https://www.forbes.com/sites/zennonkapron/2023/06/22/why-credit-card-adoption-is-rising-in-india/?sh=412a382a5589

Also we need to calculate people taking loans = 40% of Population = 40% of 1.42 billion = 568 million

So total is 568+77 = 645 million

SAM:

This will be in the age group of 25-40 which is around 36% for CC holders. This comes to around 27 million.

https://www.business-standard.com/finance/personal-finance/53-opt-for-personal-loan-even-before-30-bengaluru-most-credit-healthy-city-123110200414_1.html#:~:text=age%20of%2033.-,A%20whopping%2053%25%20of%20Indians%20took%20their%20first%20personal%20loan,before%20the%20age%20of%2025.

50% of 568 million is 284 million.

10.5 % of people can speak in English = 29.82 million

SOM:

Credit card holders, and loan users.

Tier 1/Tier 2 cities

Working people holding credit cards.

This will be users who know English, are open to using different apps like CheQ and have time to pay bills themselves instead of using autopay. Also, the users who want timely bill payment reminders and are okay to share their information with 3rd party apps.

SOM can be assumed to be 20% of SAM = 5.9 million

=================================================

Acquisition Channels

Organic

Type of search | Keyword | Avg cost per click | Search volume (avg monthly) | Difficulty to rank on seo | Target Position | Projected Click through rate | Website Lands | Website land to conversion rate | App Installs | Cost per conversion |

Use case | Emi calclutor | 0.01$ | 2740000 | 70 | 8 | 3.3 | 90420 | 6% | 5425.2 | 0.1666666667 |

Use case | credit score check | 0.04$ | 110,000 | 76 | 3 | 11 | 12100 | 6% | 726 | 0.6666666667 |

Use case | free credit score check | 0.03$ | 40,500 | 76 | 3 | 11 | 4455 | 6% | 267.3 | 0.5 |

Use case | experian credit score | 0.05$ | 27,100 | 57 | 2 | 15.8 | 4281.8 | 6% | 256.908 | 0.8333333333 |

Use case | credit card for low cibil score | 0.27$ | 9,900 | 33 | 5 | 6.3 | 623.7 | 6% | 37.422 | 4.5 |

Use case | credit card without cibil score | 0.24$ | 1,600 | 30 | 5 | 6.3 | 100.8 | 6% | 6.048 | 4 |

Use case | free credit Score | 0.03$ | 22,200 | 75 | 5 | 6.3 | 1398.6 | 6% | 83.916 | 0.5 |

Use case | my credit score | 0.06$ | 9,900 | 57 | 4 | 8.4 | 831.6 | 6% | 49.896 | 1 |

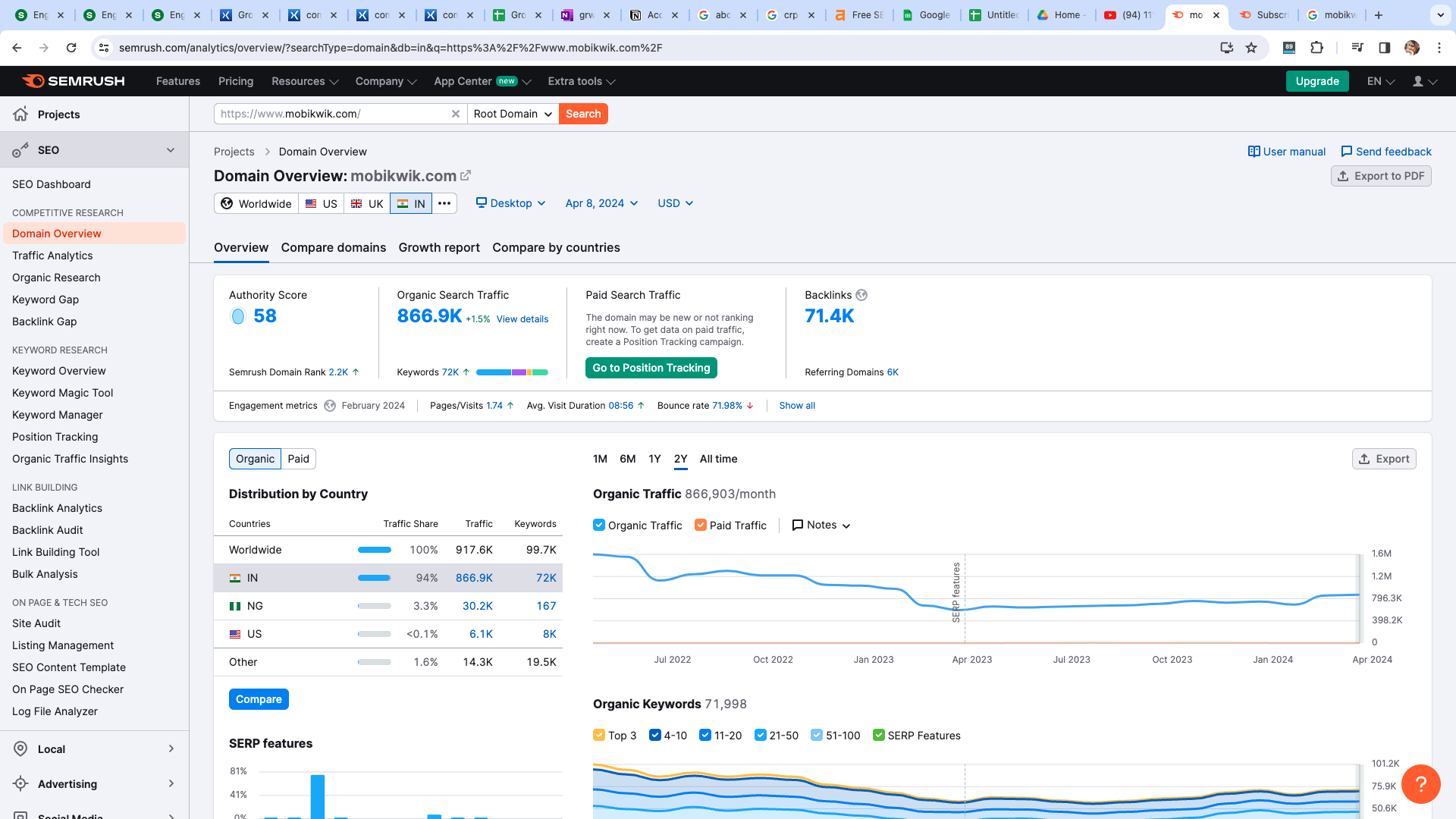

Competitor | Mobikwik | 0.07$ | 135000 | 70 | 7 | 3.9 | 5265 | 6% | 315.9 | 1.166666667 |

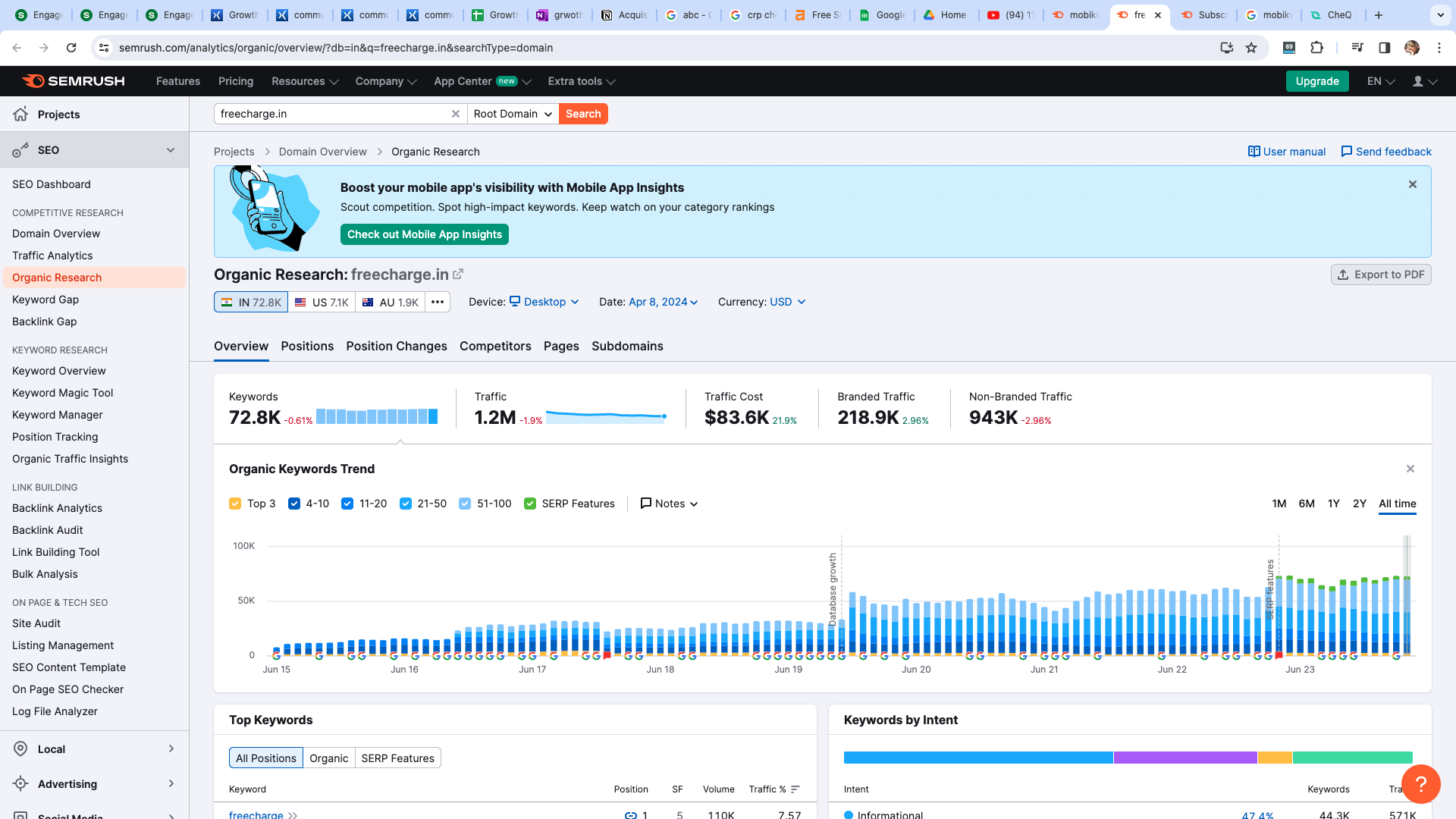

Competitor | FreeCharge | 0.02$ | 110,000 | 65 | 8 | 3.3 | 3630 | 6% | 217.8 | 0.3333333333 |

Competitor | BillDesk | 0.72$ | 33,000 | 63 | 8 | 3.3 | 1089 | 6% | 65.34 | 12 |

Competitor | Cred | 0.08$ | 60,500 | 73 | 8 | 3.3 | 1996.5 | 6% | 119.79 | 1.333333333 |

Competitor | cred coins | 0.00$ | 590 | 21 | 3 | 11 | 64.9 | 6% | 3.894 | 0 |

Competitor | cred coins value | 0.00$ | 720 | 29 | 2 | 15.8 | 113.76 | 6% | 6.8256 | 0 |

Competitor | phonepe credit card payment | 0.37$ | 1600 | 26 | 3 | 11 | 176 | 6% | 10.56 | 6.166666667 |

CheQ: Loan Emi Payment | loan emi payment | 0.10$ | 1000 | 51 | 4 | 8.4 | 84 | 6% | 5.04 | 1.666666667 |

Use Case | hdfc loan emi payment | 0.22$ | 1900 | 50 | 5 | 6.3 | 119.7 | 6% | 7.182 | 3.666666667 |

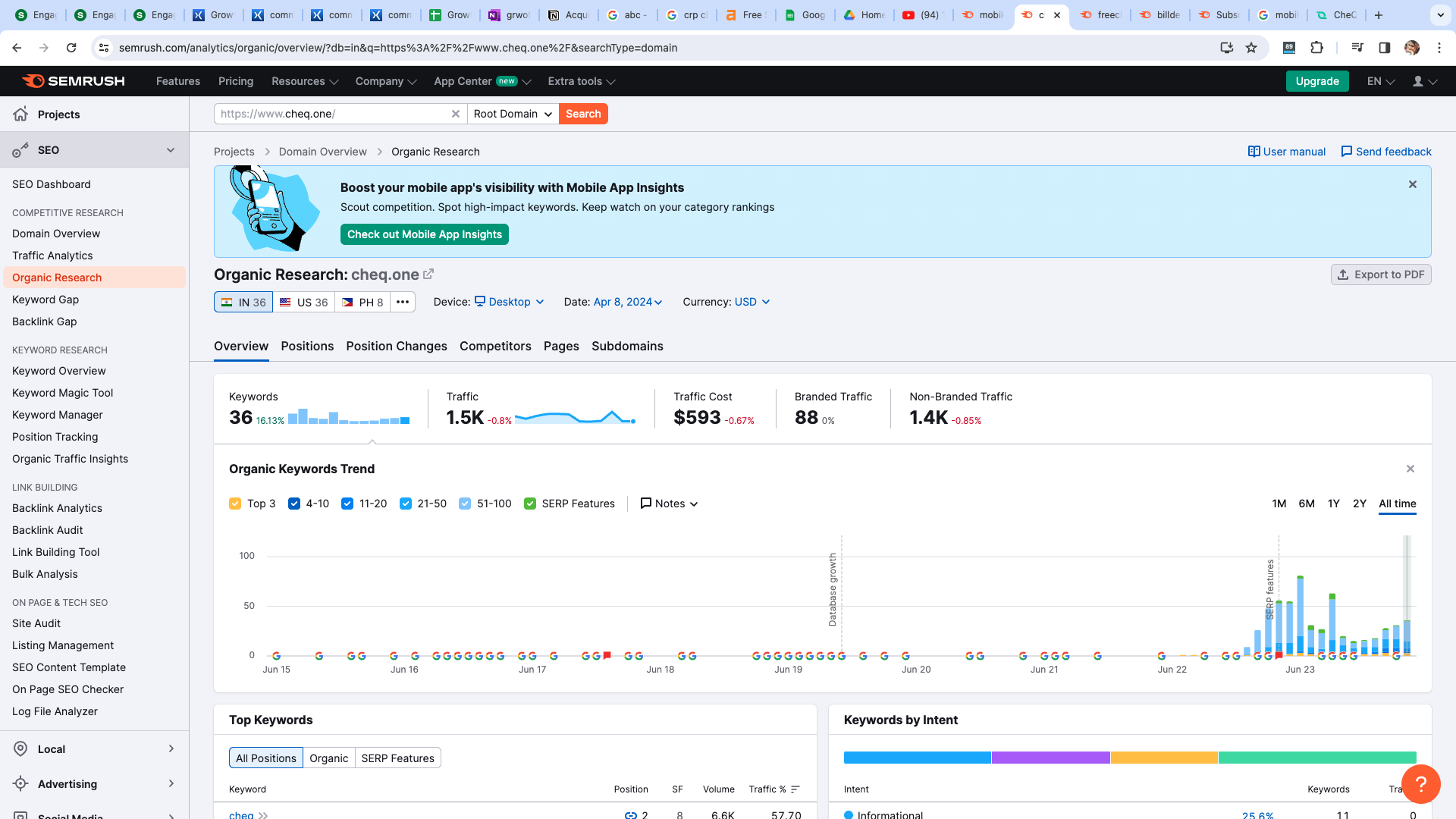

CheQ | cheq | 0.35$ | 6600 | 35 | 1 | 27.6 | 1821.6 | 6% | 109.296 | 5.833333333 |

CheQ | cheq app | 0.76$ | 1900 | 44 | 1 | 27.6 | 524.4 | 6% | 31.464 | 12.66666667 |

CheQ: Credit Card Payment | dbs bank credit card payment | 0.26$ | 880 | 21 | 3 | 11 | 96.8 | 6% | 5.808 | 4.333333333 |

CheQ: Credit Card Payment | hdfc credit card payment | 0.19$ | 110,000 | 62 | 6 | 4.9 | 5390 | 6% | 323.4 | 3.166666667 |

CheQ: Credit Card Payment | credit card bill payment offers | 0.54$ | 9,900 | 41 | 4 | 8.4 | 831.6 | 6% | 49.896 | 9 |

CheQ: Credit Card Payment | credit card payment | 0.31$ | 9,900 | 67 | 7 | 3.9 | 386.1 | 6% | 23.166 | 5.166666667 |

Use Case | sbi credit card payment | 0.24$ | 90,500 | 57 | 6 | 4.9 | 4434.5 | 6% | 266.07 | 4 |

Use Case | rbl credit card payment | 0.30$ | 60,500 | 42 | 5 | 6.3 | 3811.5 | 6% | 228.69 | 5 |

Use Case | icici credit card payment | 0.33$ | 40,500 | 50 | 5 | 6.3 | 2551.5 | 6% | 153.09 | 5.5 |

Use Case | icici bank credit card payment online | 0.30$ | 8,100 | 37 | 4 | 8.4 | 680.4 | 6% | 40.824 | 5 |

Use Case | axis bank credit card payment | 0.28 | 27,100 | 63 | 8 | 3.3 | 894.3 | 6% | 53.658 | 4.666666667 |

Use Case | credit card bill payment offers today | 0.23$ | 390 | 27 | 2 | 15.8 | 61.62 | 6% | 3.6972 | 3.833333333 |

Assumptions:

- Finding CTR through https://backlinko.com/google-ctr-stats

- Wesbite land to conversion ratio is 6%

Findings:

CheQ does not rank anywhere in the top 10 in all top keywords except for the ones related to CheQ. Even then, with CheQ it ranks second and with Cheq app only it ranks first. The performance is extremely poor. Given the fact that the discoverability is low for the app.

The competitors are doing really well.

Whereas CHeQ:

Plan of Action:

1) CheQ should rank 1st when searching for "CheQ" on google. Right now it's at 2nd position.

2) Target all the keywords where the cost per conversion <=5 $.

-> We need to optimize our website, meta-titles, descriptions, headers with the targeted keywords.

-> Need to create different articles, emi calculator on website.

-> Need to add site assets

=========================================================================================

Content Loops

Create amazing content loops to be discovered by users.

1) Answer questions in the credit cards india space "

Hook -> question/discussion headline

Generator-> CheQ members/guest fintech bloggers

Distributor -> reddit user

This space has 33k members.It's a goldmine of questions and answers.People ask questions on this space or they suggest credit cards, payment methods.If we can establish ourselves as experts here and provide general answers about credit cards, payment dates , while also adding the website link. We can increase the number of backlinks and provide value to community in form of free content.

2) Conduct AMA on Reddit.

Most famous people have AMA on Reddit. This helps people connect to the them.

Hook -> AMA

Generator -> CheQ company

Distributor -> User

3) Create a newletter, send it to subscribers.

Hook -> Newsletter title

Generator -> CheQ company

Distributor -> Users

The newsletter will contain all topics related to personal finance and also links to different website articles too. This will be very good quality content.

4) Create articles on website that users search for using SEO keywords.

Hook : The keywords found in SEO search , have catchy title with those for personal finance

Generator: Guest blogger/ CHeQ content team

Distrubutor: Users

Examples:

--> Are credit cards a trap?

--> How to keep track of all credit card bill payments.

--> Keep track of all loan payments.

--> Want lower interest on loans? Expert shares how..

Put a link to susbscribe to newsletter using this.

5) Create Youtube channel and put free valuable content on it.

- On the youtube channel, many fin-fluencers can be called for podcasts. This creates trust with the users.

- There could be a series on personal finance like how to budget, how to get best cards, how to use maximise card benefits

- Create YT shorts with the most interesting few seconds from the video and use it as hook.

Hook - video content

Generator - Fin-fluencers, host for podcasts, guests for personal finance series, customers of CheQ

Distributor - User

6) Instagram

- Instagram will have shorts of small videos. It will be usually used for information in a small amount fo time.

- Also get some famous celebrities and ask them simple personal finance questions. This creates intrigue.

- Use trending sounds like "moye moye" for showing content.

Hook - First 5 seconds with interesting questions/ celebrity/ attractive people

Creator- Cheq company creatores

Distributor channel - instagram, users will share on stories/DMs.

=================================================

Product Integration

1) Banks

CheQ will advertise credit cards of different banks, in exchange the banks will show credit card payment option as CheQ when bill generated, when buying different credit cards. This will be done on targetted users of our ICP.

2) OneCard

Partnership with onecard. When you pay bill of onecard, 2x coins are given. WHen people buy one card they are sent email about the cheq app.

3) MyGate

A section of CheQ can be shown on Mygate for paying rent and maintenance through CheQ. CheQ can also show users to download MyGate for extra security in society and to get in touch with society owners.

This will improve both reach for CheQ and MyGate.

This can work in favour of both the apps. Since this partnership has not even been considered before

4) School apss

The apps and websites of schools can show CheQ app option to pay the school fees. This can be done for major schools with high fees ie above 1 or 1.5 lac per student per year which are franchisee in major cities in India. CheQ can in turn give special offers to the committe of such schools/colleges.

5) Upcoming Indian brands

CheQ can offer their vouchers on the app and in turn CheQ can earn for listing the products.

==============================================================================

Referral

The referral option is already present in CheQ. However, it can be made better.

This is how:

1) First, give better rewards for a limited time. Right now it is 100 rs per user/ 1000 chips. For a limited time make it 5x chips. So if a user refers another user they can potentially get discount upto 500 rs per bill payment. This is only a limited period offer run between 20 days. The user will only get the coins if the person referred makes payment of 5000 rs to avail this offer.

2) Put the referral link in the rewards section as well.

3) create leaderboards for referral inside the refer and earn section.

The top 1 will get 10,000 CheQ coins.

The next 5 will get 3,000 CheQ coins.

The next 20 will get 500 CheQ coins.

The next 100 will get 100 CheQ coins.

The n, ext 500 will get 50 CheQ coins.

These coins will be on top of the coins earned and a complete referral will

This gamifies the entire referral program and produces more chances of referral.

Fourth, Have more platforms for sharing referrals. Right now, no option is given and WhatsApp opens directly as soon as we click on refer friends.

There should be options like WhatsApp, Instagram, Telegram or copy code.

Special merchandise of CheQ is givem to the users who refer.

Suppose refer 5 and get a coffee mug with CheQ's logo.

Do 10 referrals in a month and get T shirts.

Do 15 referrals and get a credit card holder on which CheQ's branding is present.

I

Fifth, right now there is no transparency in the referral section. We only get the users who have completed the payment, not the ones who have installed but not completed the payments. We can show users what action have they taken yet.

===================================================

END OF PROJECT

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.